The Italian labour market enters 2026 in a phase of broad stability. In January alone, companies planned a total of 526,820 new hires, rising to 1,429,480 over the January–March quarter. The year-on-year monthly comparison with 2025 highlights a slight decline of 0.6%, equal to around 3,220 fewer contracts, indicating a modest and non-generalised slowdown. According to the Excelsior information system report by Unioncamere and the Ministero del Lavoro (Ministry of Labour), trends remain uneven across different productive sectors, with diverging dynamics between industry, services and the primary sector.

The strongest growth is recorded in agriculture, which posts a 6.5% increase compared with the previous year, while services show broad stability, supported by tourism and personal services but held back by business-oriented activities and retail. Industry, by contrast, registers a contraction of 3.5%, more pronounced in manufacturing and more limited in construction. Within this overall context, one of the main indicators of strain in the Italian labour market shows slight improvement, with recruitment difficulty falling to 45.8% from 49.1% in January 2025. The share of hard-to-fill positions nevertheless remains high, mainly due to a lack of available candidates and, to a lesser extent, skills that do not fully match required profiles.

From a contractual perspective, fixed-term employment continues to prevail, accounting for 47.8% of planned hires, followed by permanent contracts at 21% and agency work at 11.9%. Companies also continue to make extensive use of young people under 30, who represent 27% of planned recruitments, and migrant workers, who account for 22.2% of the total, with a particularly significant role in operational services and logistics.

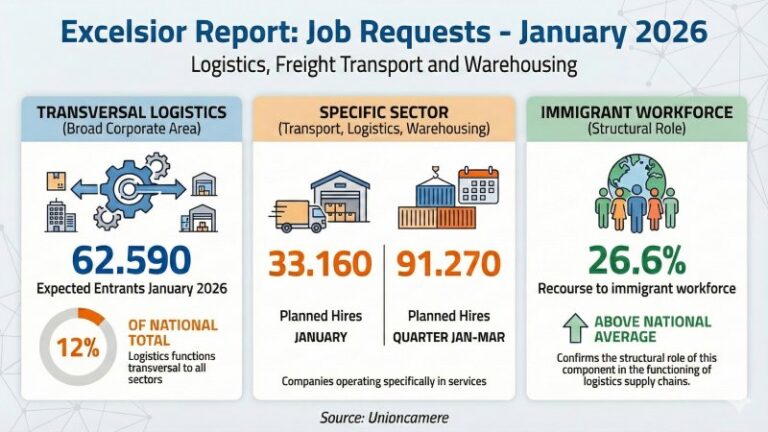

Within this national framework, logistics, freight transport and warehousing confirm their position as one of the main employment engines. Considering the logistics business area in a broad sense, including logistics functions across all economic sectors, expected hires in January 2026 amount to 62,590, equal to 12% of the national total. Narrowing the focus to companies operating specifically in transport, logistics and warehousing services, planned recruitments stand at 33,160 in January alone and 91,270 over the January–March quarter. This segment shows a higher-than-average reliance on migrant labour, at 26.6%, confirming the structural role of this workforce in the functioning of logistics supply chains.

Labour demand in the sector is divided into two main functional areas with different characteristics. Transport and distribution account for the largest volumes, with 44,320 planned hires in January and a recruitment difficulty rate of 44.6%. Functions linked to purchasing and internal goods handling, typically associated with warehousing, amount to 18,270 hires and present a more limited level of strain, with recruitment difficulty at 33.1%. The greater pressure in transport reflects higher entry barriers, linked to professional qualifications and working conditions, compared with warehouse activities.

A detailed look at the professions sought highlights the central role of drivers. Freight truck drivers are among the most in-demand profiles, with 15,130 planned hires, while the broader category of motor vehicle drivers reaches 24,070 entries, accompanied by a recruitment difficulty rate close to 58.9%, one of the highest across the entire labour market. Delivery drivers using company vehicles also show significant volumes, with 4,260 planned hires. These figures confirm a structural criticality in professional driving, where the shortage of candidates remains the main source of imbalance.

In warehousing and internal goods handling, volumes remain high, but recruitment is overall less problematic. Warehouse workers involved in goods handling number 11,740, while unskilled personnel engaged in moving and delivering goods reach 26,700 hires, with recruitment difficulty limited to 28.6%. Lower figures are recorded for specialised profiles, such as forklift operators and industrial truck drivers, which together exceed 5,000 planned hires.

Alongside operational roles, the logistics supply chain also requires clerical and technical profiles linked to flow management. Warehouse management staff number around 2,000, purchasing management staff 1,340, while warehouse and internal distribution managers stand at 220. Particularly significant is demand for commercial distribution technicians, which reaches 4,350 hires with a recruitment difficulty rate of 57.8%, reflecting growing needs for coordination, planning and integration of logistics processes.

As for educational requirements, vocational qualifications and compulsory schooling prevail, although technical and coordination roles frequently require a secondary school diploma with a focus on transport and logistics, accounting for around 9,950 planned hires, or specific qualifications in logistics systems and services, which exceed 23,000 positions.

Antonio Illariuzzi