The spot market for average container shipping freight rates began 2026 with a marked increase. According to the World Container Index, updated by Drewry on Thursday 8 January 2026, the composite index, which covers all routes considered, climbed by a significant 16% week on week, reaching 2,557 dollars per 40-foot container. The rise is mainly attributable to general rate increases applied by carriers on the main Asia–Europe and Asia–United States routes, in a context that nonetheless continues to be characterised by subdued volumes.

On the Asia–Europe routes, attention is focused in particular on the Shanghai–Genoa service, which recorded a weekly increase of 13%, equal to 458 dollars, bringing the rate to 3,885 dollars per feu. The Mediterranean route emerges as one of the most reactive at the start of the year, reflecting the introduction of new tariff levels by shipping lines. The Shanghai–Rotterdam route also shows a significant rise, up 10% week on week to 2,840 dollars.

These increases come amid an expansion in available capacity, estimated at between 5% and 7% month on month on the Asia–Northern Europe and Asia–Mediterranean routes, a factor that points to dynamics driven more by pricing policies than by a structural strengthening of demand. On the opposite leg, the Rotterdam–Shanghai route remains broadly stable, with a limited increase of 3% to 504 dollars, confirming the asymmetry between the two traffic directions.

On the Transpacific, increases are even more pronounced. The Shanghai–Los Angeles route posted a weekly jump of 26%, or 651 dollars, reaching 3,132 dollars per 40-foot container, while Shanghai–New York rose by 20% to 3,957 dollars. Here too, Drewry reports an increase in available capacity of between 7% and 10% month on month and operational indications of weak volumes from Asia to the United States. This imbalance between supply, demand and tariff dynamics leads analysts to view these rises as opportunistic and potentially short-lived. Reverse routes, such as Los Angeles–Shanghai, remain virtually stable, with minimal variations and rate levels around 721 dollars.

More moderate is the trend on the transatlantic market. The Rotterdam–New York route recorded a weekly increase of 2% to 1,685 dollars, while New York–Rotterdam was essentially unchanged at 966 dollars. The lower volatility in this area confirms a phase of greater balance compared with the ex-Asia routes.

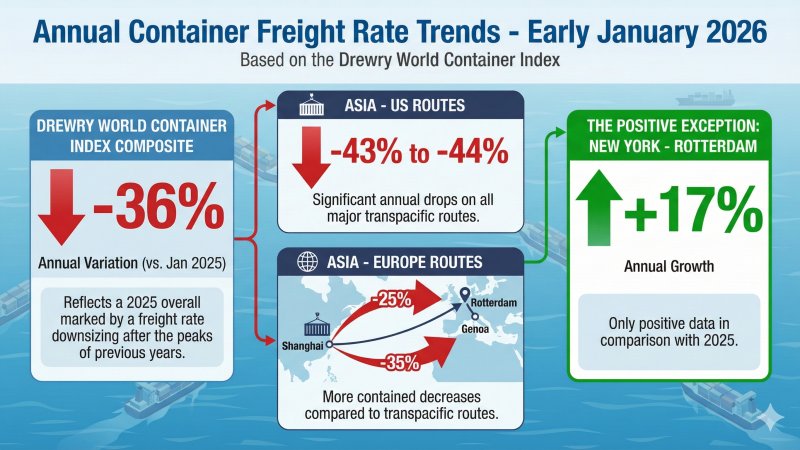

While the weekly analysis highlights a sharp rebound at the start of 2026, the year-on-year comparison paints a different picture. The composite Drewry World Container Index is 36% lower than in the same period a year earlier, reflecting a 2025 overall marked by a scaling back of freight rates after the peaks of previous years. The main Asia–United States routes show annual declines of between 43% and 44%, while the Asia–Europe lanes record more limited drops, such as -25% on Shanghai–Genoa and -35% on Shanghai–Rotterdam. An exception is the New York–Rotterdam route, which on an annual basis shows growth of 17%, the only positive figure in comparison with 2025.

Overall, the data indicate that the start of 2026 is characterised by a technical rebound in rates, driven more by carriers’ pricing actions than by a strengthening of demand. Developments in the coming weeks, with capacity increasing and volumes still weak, will be crucial in assessing the sustainability of these levels, particularly on the key routes linking Asia with Europe and North America.