The global air cargo market closed 2025 with an overall positive balance in terms of volumes, but with signs of a gradual weakening on the pricing side and cautious prospects for 2026. This is the picture outlined in an analysis by Xeneta released on 7 January 2025. In the final month of the year, demand rose by 6% year on year, outpacing the 5% increase in supply and confirming a stronger-than-expected end-of-year dynamic.

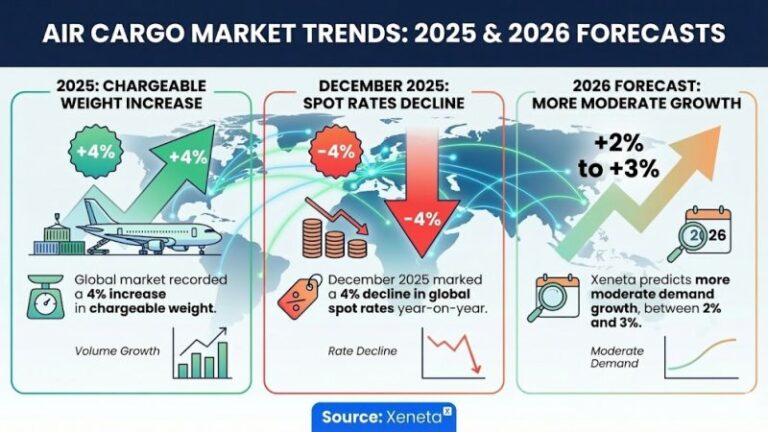

Over the year as a whole, the market recorded a 4% increase in chargeable weight, largely supported by a modal shift of some shippers from sea to air transport. Uncertainty linked to the geopolitical and logistics context, with particular reference to tensions in the Red Sea and their repercussions on global supply chains, has made air freight a more reliable solution for certain types of goods and for flows requiring greater urgency.

Xeneta describes 2025 as a turbulent year, in which negative forecasts related to the introduction of new tariffs in the United States did not translate into a contraction in volumes. On the contrary, uncertainty helped sustain demand for air capacity. According to the analysis by Xeneta’s Chief Airfreight Officer, Niall van de Wouw, the context ultimately delivered benefits to both sides of the market: service providers saw volumes exceed expectations, while shippers were able to take advantage of a gradual easing of rates in the second half of the year.

On the pricing front, December 2025 saw a 4% year-on-year decline in global spot rates, with an average level of 2.83 US dollars per kilogram. The figure confirms a downward trend that characterised much of the second half, in a context of rebalancing between demand and available capacity.

A corridor-by-corridor analysis highlights differentiated dynamics. Routes between Europe and North America recorded the steepest annual decline, down 13%, despite a 17% month-on-month increase in December linked to the seasonal reduction in passenger capacity during the winter period. On lanes between South-east Asia and Europe, rates fell by 11% year on year to 3.58 US dollars per kilogram, but rose by 6% month on month. Routes between North-east Asia and North America showed relative month-on-month stability, with a 4% increase, against a 6% annual decline, and average rates of 5.15 US dollars per kilogram.

Mainland China stands out as a case in its own right. Rates to Europe and North America in December were only 1% lower than in the same month of 2024, pointing to a tighter balance between demand and supply. However, the 9% month-on-month increase in rates from China indicates a more pronounced local imbalance, with temporary pressure on available capacity.

One of the central themes of Xeneta’s analysis concerns the slowdown in cross-border e-commerce from China, particularly towards the United States. E-commerce-related exports from China to the US collapsed by 51% in October and 52% in November year on year. Before the introduction of new bans linked to the “de minimis” threshold, this corridor accounted for around 3% of global air cargo volumes. The data signal a direct impact of new tariffs and regulatory restrictions on air traffic for small, high-value parcels.

The European picture is, for now, different. E-commerce volumes from China to the European Union continue to grow, with a 29% increase in November, albeit slowing from the +47% recorded in October. Here too, however, the regulatory environment is set to change. From 1 July 2026, the European Union will introduce fixed customs duties on small parcels, with the aim of reducing distortions linked to low-value shipments and strengthening customs controls.

On the Chinese side, new tax reporting rules for e-commerce platforms, including global operators such as Amazon and Temu, will come into force from October 2025. The new provisions include significant penalties for non-compliance and introduce additional operational complexity, with potential effects on the fluidity of flows and on overall supply chain costs.

Market uncertainty is also reflected in the contractual strategies adopted by operators. Xeneta’s analysis shows that in the fourth quarter of 2025 only 24% of new contracts signed by shippers had a duration of 12 months, down 20 percentage points compared with the previous quarter. At the same time, the use of shorter contracts increased, with 32% of agreements valid for six months and 26% limited to three months.

Freight forwarder behaviour confirms a structural preference for the short term. Almost half of the volumes handled by forwarders continue to be purchased on the spot market, with contracts valid for up to one month, a practice that has consolidated in the post-pandemic period and reflects the need to maintain flexibility in a highly volatile environment. The chart on overall contract validity clearly shows this shift in approach. In the third quarter of 2025, 45% of contracts had an annual duration, while in the fourth quarter this share fell sharply in favour of shorter agreements. The data suggest that a significant part of the market expects further rate reductions in the short term and prefers to avoid long-term commitments.

Looking ahead to 2026, Xeneta forecasts more moderate demand growth of between 2% and 3%. Market fundamentals, according to the analysis, point overall to the downside in the absence of new exogenous shocks. However, the experience of 2025 confirms that air cargo remains highly sensitive to geopolitical, commercial and regulatory dynamics, with a balance that can shift rapidly in the event of new crises or restrictions.

Anna Maria Boidi