The European Union’s industrial vehicle market went through a challenging 2025, marked by a generalised fall in registrations across the main countries. According to data released by the manufacturers’ association Acea (European Automobile Manufacturers’ Association), the unfavourable economic environment had a direct impact on demand. Overall, new registrations of commercial vehicles fell by 8.8%, while industrial vehicles declined by 6.2%.

The negative trend affected all the Union’s largest markets. In the van segment, France, Germany and Italy made a significant contribution to the overall decline, while Spain moved in the opposite direction. In the industrial vehicle segment, both medium and heavy vehicles saw contractions in all major countries, with particularly sharp falls in Germany. The picture confirms a phase of structural demand slowdown, linked to economic uncertainty and high operating costs for transport and logistics companies.

Against this backdrop, the transition towards electric powertrains continues, but at a pace still considered insufficient. The overall share of electric vehicles has increased, yet uptake remains limited by inadequate enabling conditions. Incomplete charging infrastructure, high energy costs, an unfavourable total cost of ownership and uneven regulatory frameworks between countries continue to slow large-scale adoption.

Looking in detail at commercial vehicles up to 3.5 tonnes, new registrations in the European Union fell by 8.8% in 2025. France recorded the steepest decline at minus 5.6%, followed by Germany (-5.4%) and Italy (-5%). Spain again bucked the trend, posting growth of 11.7%. Diesel remains the dominant powertrain, with 1,168,561 units registered, but volumes fell by 12.8%. Diesel’s market share dropped to 80.7%, from 84.4% the previous year. Petrol powertrains saw an even sharper reduction (-31.9%), falling to a 4.4% share.

Electric vans have now reached an 11.2% share of the European market, up from 6.1% in 2024. Registrations of hybrid vans also rose by 21.4%, although they still account for only 2.7% of the total. In Italy, the light commercial vehicle market closed the year with 188,373 registrations, down around 5% from 198,219 in 2024. Within this total, electric vehicles more than doubled, rising from 4,296 to 10,307 units (+140%), but the European comparison remains unfavourable: France registered 37,758 electric vans in 2025, up sharply from 27,059 the previous year.

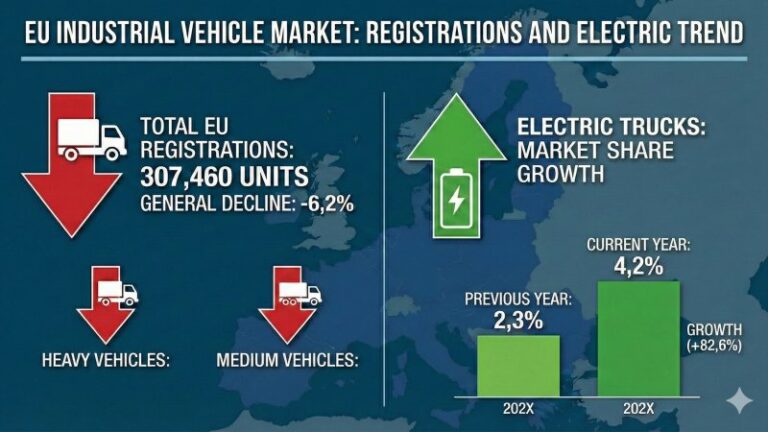

In the industrial vehicle segment, new registrations in the European Union fell by 6.2%, to a total of 307,460 units. The decline was driven by a 5.4% drop in heavy vehicles and an even steeper contraction in the medium segment (-9.9%). All major markets recorded negative results: Germany closed the year down 12.2%, France down 9% and Spain down 3.6%.

Diesel continues to hold a largely dominant position among medium and heavy vehicles, accounting for 93.2% of new registrations, despite an 8% reduction in volumes. Electric trucks above 3.5 tonnes reached a market share of 4.2%, up from 2.3% the previous year. The main impetus came from the Netherlands, Germany and France. The Netherlands recorded a 205.4% increase in electric truck registrations, despite an overall collapse of 40.8% in total truck registrations. Germany and France followed with growth of 39.6% and 30.5% respectively. Together, these three countries account for around two thirds of the European electric industrial vehicle market.

Massimiliano Barberis