From 1 January 2026 Contargo adds two new building blocks to its European intermodal network through a double corporate move combining geographic expansion with a strengthening of rail expertise in the port environment. Entry into Austria via Cargo-Center-Graz Logistik extends the operator’s access to Adriatic ports, while the acquisition of PortShuttle Rotterdam internalises a key function in managing rail flows at Europe’s largest port. The transactions are part of a broader trajectory that in 2025 saw the launch of continental rail corridors and an acceleration of decarbonisation efforts through electric trucks, charging infrastructure and hybrid barges on the Rhine.

In Austria, Contargo has acquired a 50% stake in Cargo-Center-Graz Logistik, the company operating the Cargo-Center-Graz intermodal terminal in Werndorf, in the Graz area. The transaction involves doubling the share capital to €70,000, subscribed by Contargo Beteiligungs, which becomes a joint shareholder alongside Cargo-Center-Graz Betriebsgesellschaft, previously the sole owner. According to Contargo, the objective is to structurally integrate the rail connections already in operation between Graz and southern ports, creating a stable platform for traffic towards the Adriatic and south-eastern Europe.

Ccgl currently operates rail services with frequencies including Koper–Graz–Koper with four round trips per week, planned to increase to six in 2026, as well as Koper–Bilk–Enns–Koper with one weekly round trip and Graz–Enns–Graz with two weekly round trips. Extending services to the ports of Koper and Rijeka reflects a diversification strategy away from traditional western port gateways and targets an area where rail accounts for a significant share of volumes. The port of Koper closed 2025 with 1,272,161 teu, up 12.2%, with rail’s share of hinterland transport indicated at over 50%. At the same time, construction of the new Divača–Koper line, scheduled for completion at the end of March 2026, is a contextual factor likely to affect capacity and reliability on the Adriatic corridor.

In Rotterdam, from 1 January 2026 Contargo has acquired 100% of PortShuttle Rotterdam, previously owned by the Port of Rotterdam Authority, which will continue to operate under the same name. PortShuttle specialises in train management, slot coordination and container shunting within the port’s rail network. The acquisition is consistent with an operational evolution already under way: since 1 November 2025 Contargo has independently managed train operations, and bringing the company in-house allows it to consolidate skills, processes and long-standing relationships. Direct control of a rail orchestration function within the port reduces external dependencies at a node where congestion and variability in vessel arrivals can amplify knock-on effects for trains, barges and last-mile operations.

The two transactions are anchored in a network comprising 24 container terminals, mostly trimodal, across six European countries, 11 service offices and a workforce of 1,500 employees, with 2024 turnover of €690 million and volumes of 1.9 million teu handled. The company reports a modal split of 61% by barge and rail, 29% by truck for local transport and 10% by direct road haulage.

In 2025 Contargo complemented its traditional port–hinterland services with a first series of continental rail corridors not directly dependent on maritime port connections. The move is presented as an extension of the company’s activity perimeter into continental traffic, aimed at capturing regular long-distance flows and offering alternatives to road transport amid driver shortages and growing demand for lower-emission solutions.

The first service, the Duisburg–Dourges Shuttle, was launched on 1 September 2025, linking Duisburg Intermodal Terminal with Lille Dourges Conteneur Terminal with three fixed-schedule round trips per week. The corridor is designed to feed, via Dourges, a network of destinations in France, from Fos-sur-Mer to Lyon and Marseille, as well as Paris and Rennes, and corporate plans include a connection to London from January 2026. Dourges is also a site where Contargo has long been present with a 10% stake in the terminal, a factor that reduces typical start-up risks in terms of capacity access and operational control.

A few weeks later, on 26 September 2025, the Poland–France Shuttle was inaugurated, structured around two routes: a direct Dourges–Krzewie service with one weekly round trip, and a second Dourges–Kutno scheme routed via Duisburg and continuing with a partner service of up to five weekly round trips on the Duisburg–Central section. The offering covers containers and semi-trailers and also extends to non-craneable units via the R2L platform for the Dds service, with positioning tailored to long-distance combined transport demand. Contargo estimates that the combined Dds and Pfs services can eliminate up to 1,500 truck journeys per month on the routes concerned.

The evolution of rail products comes against a challenging backdrop in terms of port reliability. Contargo has repeatedly highlighted the deterioration of conditions in the ports of Rotterdam and Antwerp, with declining terminal productivity, barge waiting times of up to five days and difficulties in maintaining reliable planning, to the point of having to deploy additional capacity to preserve service frequencies. In this scenario, from 22 April 2025 the congestion surcharge in western ports was increased from €15 to €28 per container per direction, until further notice.

These factors were compounded by labour actions with direct impacts, including the general strike in Belgium on 31 March 2025 and the strike in the port of Rotterdam from 8 to 13 October 2025, which led to closures of maritime terminals and significant delays for inland waterway and rail traffic, as well as additional storage and handling costs to manage blocked or undischarged containers. Strengthening rail functions in Rotterdam and building continental rail alternatives can also be seen as an organisational response to a context in which port variability increasingly propagates across the entire intermodal chain.

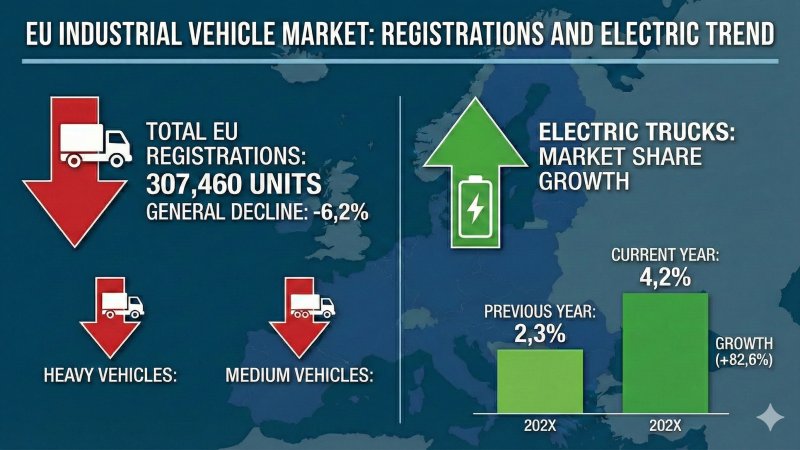

On decarbonisation, the company is expanding its fleet of electric heavy-duty vehicles. In January 2026 it received 33 new Daf XD Electric tractor units, bringing the number of electric trucks in operation to 90 across 15 locations in Germany. The increase is linked to a strategy focused on scalability in real-world operations, with primary use in local container transport within combined transport, notably the last mile between terminals and customers. Eighty-six vehicles and the associated charging infrastructure fall within the scope of Ksni funding, coordinated by Now GmbH with approvals from Balm, while at the beginning of 2025 Contargo also added 20 Mercedes eActros 600 units to its fleet.

Fleet growth is matched by infrastructure development. Contargo reports 90 fast-charging points installed at 16 locations, supplied with green electricity, with further expansions under way at several sites. The associated commercial offering, Econtargo, is a “one-stop-shop” solution combining electric last-mile transport with main haulage by rail or barge, delivering up to a 94% reduction in CO2 compared with all-road transport. According to Contargo, this result comprises a 46% reduction through combined transport and a further 48% through electric trucks and electrified or hybrid barges, alongside green electricity for rail and terminals, with the remaining 6% mainly linked to wheel-to-tank emissions.

Alongside the road component, the company is renewing its inland waterway fleet. On 24 September 2025 Rhenus and Contargo presented the hybrid pusher barge combination Mannheim I+II in the port of Duisburg, featuring hybrid propulsion and a remote steering system developed under the FernBin project, with a permanent control station planned in Duisburg and a new project phase scheduled for 2026. The barges are 193 metres long, equipped with five Euro VI diesel engines running on Hvo100, an 840 kWh battery system and provisions for future hydrogen fuel cells. They also include solutions for low-water operation, enabling use at depths down to 1.20 metres thanks to the propulsion concept and weight distribution, a key factor for the resilience of Rhine transport during periods of low water.

Pietro Rossoni