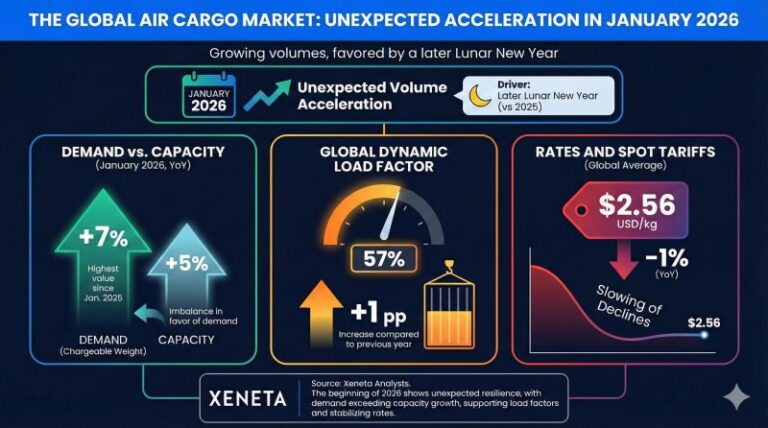

The global air cargo market opened 2026 with an unexpected acceleration in volumes, supported by a later Lunar New Year compared with 2025. According to analysts at Xeneta, demand measured in chargeable weight rose by 7% year on year in January, the strongest increase since January 2025, against a 5% rise in capacity. This imbalance pushed the global dynamic load factor to 57%, up one percentage point from a year earlier.

On the pricing front, the slowdown in declines brought average global spot rates to USD 2.56 per kilogram, down by just 1% year on year. Xeneta cautions, however, that January data remain heavily influenced by the Asian calendar and currency dynamics, with a weaker dollar tending to make averages expressed in US currency appear more resilient.

On the Asia–Europe lane, and particularly from North East Asia into the European market, spot rates fell by 6% year on year in January. The trend points to capacity growing faster than demand, with a significant contribution from the slowdown in cross-border e-commerce.

The picture looks even more fragile when examining data on e-commerce shipments from China. According to Chinese customs, low-value and e-commerce exports fell by 9% year on year in December, marking the first decline since January 2022 after two months of stagnation. Efforts by major Chinese platforms to offset the contraction of the US market by strengthening their presence in Europe had supported flows for much of 2025, when growth towards Europe reached 54% in the first eleven months. In December 2025, however, growth slowed to around 8%, and excluding Russia, Chinese e-commerce sales to the rest of Europe fell by 23% year on year. This slowdown has a direct impact on an air cargo market that globally depends on e-commerce for 20–25% of annual volumes.

On the westbound transatlantic corridor, January presented a contrasting picture. Spot rates increased by 3% year on year, despite a 4% decline in chargeable weight compared with the same month of 2025. According to Xeneta, this divergence partly reflects the impact of US tariff threats, which envisaged a 10% increase in import duties on goods from eight European countries before being withdrawn on 21 January. The episode highlighted the speed of reaction among shippers and, at the same time, the climate of uncertainty that encourages margin protection through bringing forward or reorganising shipments. In this context, the transatlantic route once again proved sensitive to short-term political and trade factors rather than to structural demand dynamics.

On the Asia–USA lane, downward pressures are more pronounced, especially for e-commerce. With the US ban on the de minimis regime now fully in force, e-commerce exports from China to the United States fell by more than 50% year on year for the third consecutive month in December. Over the whole of 2025, the overall decline reached 28% compared with the previous year. Even so, spot rates from North East Asia to North America limited their fall to 3% year on year in January, thanks to a rapid reduction in dedicated cargo capacity, particularly freighters. The situation is different from South East Asia to North America, where capacity expansion pushed rates down by more than 10% year on year, accompanied by a month-on-month decline of between 10% and 16%, reflecting the negative seasonality typical of the start of the year.

Overall, Xeneta stresses that the loss of momentum in e-commerce, already evident in autumn 2025, has now taken on the characteristics of a trend. If volume levels were to remain flat or decline further, the impact would extend to the growth plans of airlines and freight forwarders, including cargo aircraft conversion programmes that assume high and stable demand.

Added to this are uncertainties linked to maritime transport. A more structural return of routes via the Red Sea and the Suez Canal could reduce reliance on air freight in the medium term, but operational and security challenges make a rapid shift of flows unlikely as early as the first quarter of 2026. In the short term, this instability could soften the negative impact of the e-commerce contraction on air volumes, without removing its structural implications.

Anna Maria Boidi