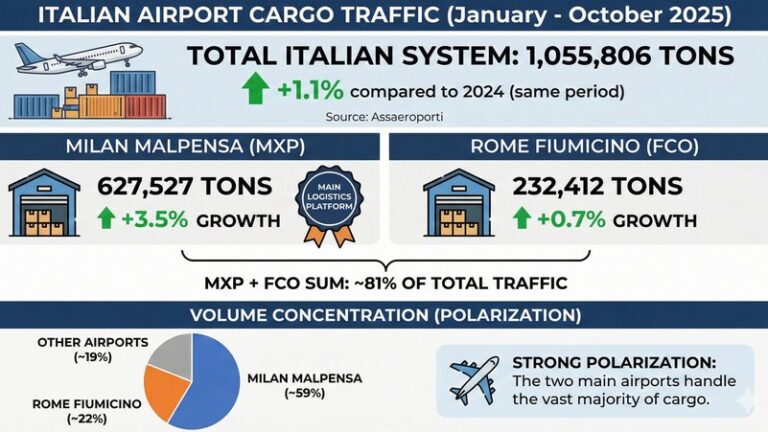

In the first ten months of 2025, Italy’s airport system handled a total of 1,055,806 tonnes of freight, up 1.1 per cent on the same period in 2024, according to figures from Assaeroporti. The most striking aspect is the strong concentration of volumes at a handful of airports, particularly Milan Malpensa, which processed 627,527 tonnes, an increase of 3.5 per cent, and continues to serve as the country’s main air logistics platform. Rome Fiumicino, the second-largest cargo airport, reached 232,412 tonnes with a more modest rise of 0.7 per cent. Together, the two gateways account for roughly 81 per cent of Italy’s air cargo traffic, confirming a highly polarised structure.

Overall performance is driven almost entirely by the major mixed hubs. Malpensa shows steady growth, aligned with demand from international e-commerce and the industrial supply chains of northern Italy. Fiumicino maintains a stable position in the cargo segment, supported by integration with long-haul passenger networks, albeit without signs of strong expansion. Venice handled 52,480.2 tonnes, down one per cent in a context of general slowdown across airports in the North-East.

The second tier of airports, those handling between 10,000 and 50,000 tonnes, presents a less favourable picture. Bologna, with 45,049 tonnes, recorded a decline of 5.3 per cent, a notable result for an airport serving an area with a strong manufacturing and agri-food base. Brescia fell 17 per cent to 26,055 tonnes, confirming the diminishing role of what was once a historic cargo hub in northern Italy. Bergamo, by contrast, grew by 4.1 per cent to reach 19,988 tonnes, supported by the express courier segment. Pisa posted a slight decline of 1.7 per cent but remained broadly stable.

Central Italy shows more pronounced signs of difficulty. Rome Ciampino is the most significant case, with volumes down 32.3 per cent to 8,612.4 tonnes. Trieste dropped to 17.4 tonnes, an 84.1 per cent decrease, indicating an almost complete contraction of cargo activity. Southern Italy presents a mixed picture. Taranto-Grottaglie grew by 50.1 per cent to 2,789 tonnes, reaffirming its role as an airport serving industrial and aerospace supply chains. Naples handled 8,303.9 tonnes, up 4.6 per cent, supported by e-commerce-related traffic and an improved cargo offering in recent years. Catania declined by 2.8 per cent, while Bari fell 15 per cent, underscoring overall fragile demand dependent more on niche segments than on consolidated flows.

The overall picture depicts a system in delicate balance, where national growth relies almost entirely on Malpensa’s strength and Fiumicino’s stability. Regional airports in the North and Centre are struggling to maintain volumes, likely due to a combination of freight shifting to road transport, concentration of operations at major hubs and the reorganisation of courier networks. Southern Italy shows mixed dynamics, with few cases of stable growth and fluctuations often linked to niche traffic.

Antonio Illariuzzi