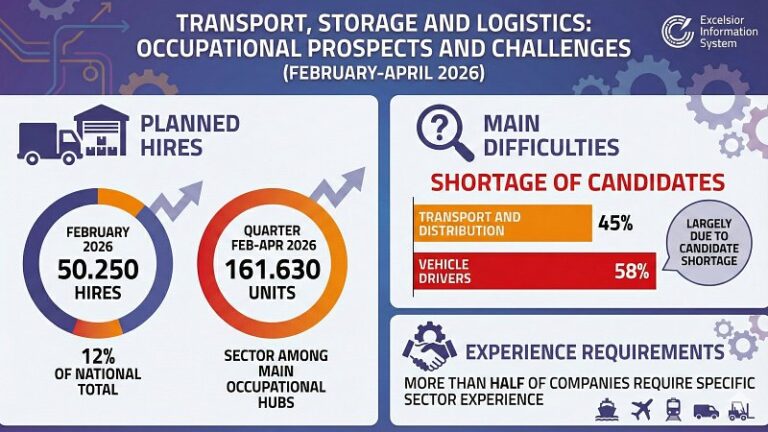

- In February 2026, Italian transport, warehousing and logistics companies plan 50,250 new hires, accounting for 12% of the national total, according to the Excelsior Information System. For the February–April quarter, demand rises to 161,630 positions, confirming the sector as one of the country’s main sources of employment.

- The main challenge remains recruitment. The shortage rate reaches 45% in transport and distribution, climbing to 58% for vehicle drivers, largely due to a lack of available candidates. More than half of companies require specific sector experience.

- The sector also relies heavily on migrant workers, who account for 27.7% of planned hires. Road haulage drivers and warehouse operatives are leading demand. Geographically, recruitment is concentrated in areas with the highest industrial and logistics density, with knock-on effects on local supply chains.

In Italy’s labour market in February 2026, transport, warehousing and logistics confirm their role as a cornerstone of staff demand. According to the Excelsior Information System, companies in the sector plan 50,250 hires in February alone, equal to 12% of the national total. The projection for the February–April quarter rises to 161,630 positions, pointing to sustained demand across the entire distribution chain.

Transport and distribution account for the largest share, with 35,490 planned hires, representing 70.6% of the logistics segment. Procurement and internal goods handling stand at 14,760 positions. The figures underline the operational weight of driving, delivery and physical flow management activities compared with coordination functions.

Heavy goods vehicle drivers are the most sought-after profile, with 11,910 planned hires in February. They are followed by warehouse operatives handling goods, with 10,750 positions. Van drivers account for 2,500 roles and delivery staff for 2,350, while warehouse logistics clerks total 1,230. The hierarchy of demand therefore highlights a concentration on operational roles directly linked to goods distribution.

The central issue remains recruitment difficulties. In transport and distribution, the mismatch reaches 45%. For industrial vehicle drivers, the share rises to 58%, of which 37.4% is attributed to a lack of candidates available on the market. Experience is a key selection criterion: 52% of companies require specific sector experience and a further 20% experience in the profession. This approach narrows the potential entry pool, particularly for driving roles that require licences and well-established operational skills.

The sector also confirms the strong presence of migrant workers, who account for 27.7% of planned hires, placing transport and warehousing among the top six sectors by share of foreign staff sought. In particular, low-skilled occupations involved in moving and delivering goods total 24,120 planned hires, with a significant presence in logistics.

As for education and training, demand is focused on technical and vocational qualifications. There is a requirement for 7,410 upper secondary diplomas in transport and logistics, with a recruitment difficulty rate of 40%. Even higher is demand for vocational qualifications in logistics systems and services, with 18,690 planned hires and prior experience required in 52% of cases. The data point to alignment between operational needs and dedicated training pathways, but also to ongoing tension between demand and the effective availability of qualified profiles.