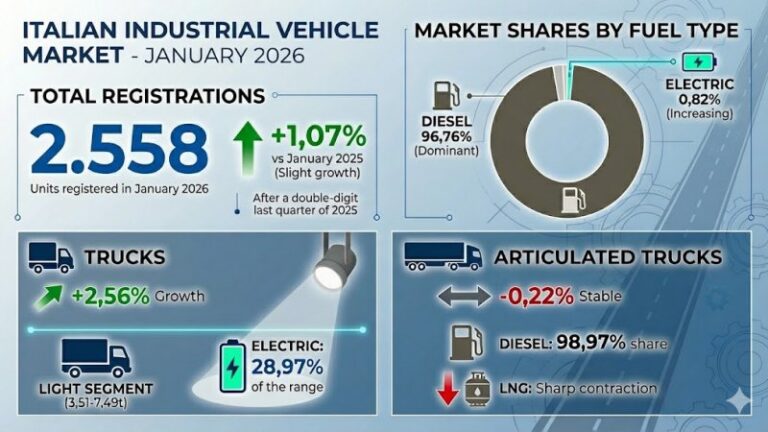

- The Italian heavy goods vehicle market began 2026 with 2,558 registrations, up just 1.07% on January 2025, following a final quarter of 2025 marked by double-digit growth. Diesel retained a 96.76% market share, while electric vehicles, despite increasing volumes, accounted for just 0.82%.

- Rigid trucks rose by 2.56%, with electric models expanding in the light segment to 28.97% of the 3.51–7.49 tonne category. Tractor units remained broadly stable (-0.22%), with diesel at 98.97% share and LNG in sharp decline.

- In the light commercial vehicle segment, January recorded 14,290 registrations (-5.2% year on year). Pure electric fell to a 2.4% share from 4.5% in December 2025. The sector is awaiting the implementation of new incentives announced by the Ministero delle Imprese (Ministry of Enterprises).

In January 2026, the Italian heavy goods vehicle market slowed markedly. According to data released by Federauto, the sector recorded 2,558 registrations, up 1.07% compared with January 2025. This brings to an end the strong momentum seen in the final quarter of 2025, which posted increases of 16.3% in October, 16.1% in November and 11.1% in December, partly supported by comparison with a weak 2024. Full-year 2025 closed at 27,005 units, down 3.72% on the previous year.

The market remains firmly anchored to diesel, although its share edged down from 98.10% to 96.76%. Electric vehicles rose by 213.33% year on year, but this percentage reflects very low volumes, with 47 registrations representing 0.82% of the total, while natural gas remains marginal.

Registrations of rigid trucks reached 1,204 units, up 2.56%. Among body types, box bodies confirmed their leading position with 617 units and a 51.25% share. Urban waste collection vehicles (+33.85%) and flatbeds (+22.22%) increased, while refrigerated bodies (-22.94%), concrete mixers (-38%) and tankers (-18.42%) declined, signalling a rebalancing of demand between construction and environmental services.

By gross vehicle weight, the most significant figure was in the light segment between 3.51 and 7.49 tonnes, which recorded 145 units, up 81.25%. In this category, electric vehicles reached a 28.97% share, with 42 units and growth of 320% compared with January 2025. In the medium segment between 7.5 and 16 tonnes, 238 units (+3.48%), and in the heavy segment above 16 tonnes, 821 units (-4.98%), diesel exceeded a 98% share, confirming that the energy transition remains concentrated in lighter segments.

Within rigid trucks, rental activity also expanded, reaching 90 units, equal to 7.48% of the market, up 181.25% year on year. Federauto links this trend to the 2024 regulatory update and the practical effects of the 2022 European Mobility Package. The phenomenon had already strengthened in 2025, with cumulative annual growth of 90.6% compared with 2024.

In the tractor unit segment, registrations remained broadly stable at 1,354 units (-0.22%). Diesel accounted for 98.97% of the total, while electric models were limited to four units. Natural gas fell sharply by 88%, with just three units registered. Here too, rental grew to 56 units, representing 4.14% of the market (+93.10%), while third-party haulage dominated with a 93.21% share.

Iveco retained its leading position in the Italian market with a 26.66% share, but recorded a sharp decline of 10.26%. By contrast, registrations of Volvo Trucks (+30.13%) and Mercedes-Benz (+26.43%) increased, while Daf (-18.36%) and Renault Trucks (-29.17%) declined. According to Federauto, the competitive dynamic reflects a context of selective demand focused on fleet renewal.

In the light commercial vehicle market up to 3.5 tonnes gross vehicle weight, 2026 opened on a negative note. According to Unrae, January registrations totalled 14,290 units, down 5.2% compared with 15,070 in the same month of 2025, which had itself recorded a 16.0% decline on January 2024. This marks the third consecutive month of contraction.

Pure electric vehicles declined both in volume and share, accounting for 2.4% of the market, almost half the 4.5% recorded in December 2025 and also down from 2.7% in January 2025, when incentives were not in place. According to Unrae, the effect of subsidies from the Ministero dell’Ambiente (Ministry of the Environment) already appears to be fading, while the reimbursement procedure for dealers has yet to be completed. Further support may come from the incentives announced by the Ministero delle Imprese (Ministry of Enterprises) at the Automotive Roundtable on 30 January, with €200 million allocated for the 2026–2030 period. However, implementation timelines make an immediate impact on 2026 registrations unlikely.

The market structure shows a decline in private buyers to 16.1% (-1.2 percentage points), while self-registrations rose to 11.9% (+4.7 points). Long-term rental fell to 25.6% (-4.2 points), short-term rental increased to 4.8% (+1.2 points), and public bodies and companies remained at 41.6%, albeit down by half a point.

By powertrain, diesel lost 5.6 points to 79.1%. Petrol fell to 3.4%, LPG rose to 3.7% (+1.6 points), hybrids reached 9.1% (+3 points), while plug-in vehicles increased from 0.4% to 2.3%. Weighted average CO2 emissions declined to 187.5 g/km (-1.8% compared with 190.9 g/km in January 2025). Overall, the picture points to cautious demand, with an energy transition that remains fragmented and heavily dependent on incentives and infrastructure.

A.I.