The Italian market for light commercial vehicles up to 3.5 tonnes showed clear signs of recovery in September 2025, with 16,905 new registrations — an 18.8% increase on the 14,226 units recorded in the same month of 2024, when the segment suffered a 19.3% contraction. However, volumes remain 4.1% below those of September 2023. The figure confirms the positive trend already seen in August, after eleven consecutive months of decline.

From January to September 2025, total registrations reached 141,642 units, down 6% compared with 150,667 in the same period of 2024. The autumn rebound is therefore not yet enough to offset the weakness of the first half of the year.

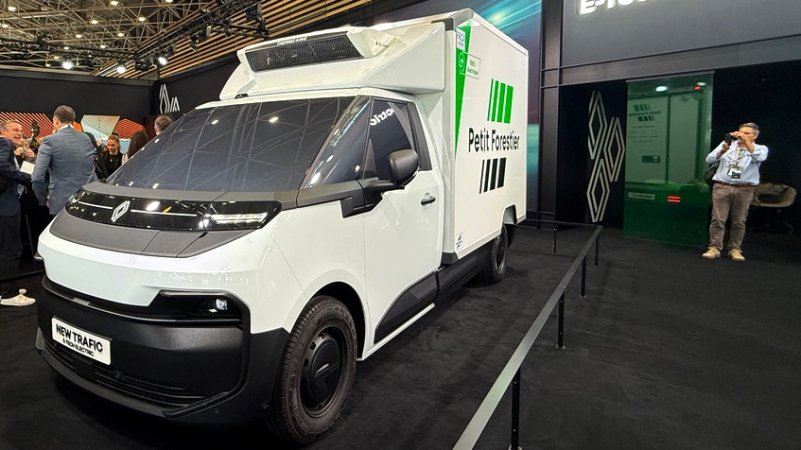

In terms of sustainable mobility, September marked an increase in the share of fully electric vehicles, which rose to 5.7% of the total, up from 2% in September 2024. This growth is being driven by long-term rental, which has boosted the spread of zero-emission models. Across the first nine months of 2025, electric vehicles accounted for 4.5% of the market, compared with 1.8% a year earlier.

On 15 October 2025, the Ministry of the Environment will launch an incentive scheme worth almost €600 million to support the purchase of electric commercial vehicles by micro-enterprises based in functional urban areas. The subsidy may cover up to 30% of the purchase price, excluding VAT, with a maximum of €20,000 per vehicle. At the same time, the Ministry of Enterprises is finalising its own eco-bonus scheme for commercial vehicles, drawing on unspent funds from previous years. UNRAE has called for coordinated management between the two programmes to avoid overlaps and ensure greater effectiveness of the incentives system.

Roberto Pietrantonio, president of the foreign manufacturers’ association, stressed the need for joint action between associations and institutions to support the sector, highlighting as priorities the development of charging infrastructure for light commercial vehicles and the creation of a 50% tax credit for private investment in fast-charging stations over 70 kW during the 2026–2028 period.

At European level, the manufacturers’ association ACEA reiterated that the 2035 zero-emission target for cars and vans no longer appears achievable within the planned timeframe — not due to supply shortages, but because of barriers related to demand, costs and enabling factors. ACEA has therefore proposed a more flexible compliance mechanism, based on a five-year horizon between 2028 and 2032.

The structure of the Italian market in September highlights the dominance of long-term rental, which rose by 9.6 points to reach 42.2% of registrations, followed by companies and public bodies (34.4%), private customers (12.3%) and short-term rental (5.7%). Self-registrations accounted for 5.4%.

By fuel type, diesel remains predominant but has fallen to 80.6% of the total (-5 points), while hybrid vehicles account for 6.7% (+0.9 points) and electric vehicles have reached 5.7% (+3.7 points). Petrol engines remain stable at 3.9%, plug-ins have risen to 1.3% and LPG has dropped to 1.9%. The combined effect of the rise in electric vehicles and the decline in traditional engines led to a reduction in average CO₂ emissions: 174.7 g/km in September versus 195.2 g/km in 2024, a 10.5% decrease (-20.5 g/km). Over the first nine months of the year, emissions fell by 6.2%.

The market continues to be dominated by national brands, with Fiat and Iveco maintaining their leadership positions. The best-selling model in September was the Fiat Doblò with 2,441 units, followed by the Fiat Ducato (1,762), Iveco Daily (1,180), Ford Transit Custom (785) and Ford Transit (731). From January to September 2025, the Fiat Ducato leads the rankings with 15,825 registrations, ahead of the Fiat Doblò (15,650), Iveco Daily (10,391), Ford Transit (8,604) and Ford Transit Custom (7,727).