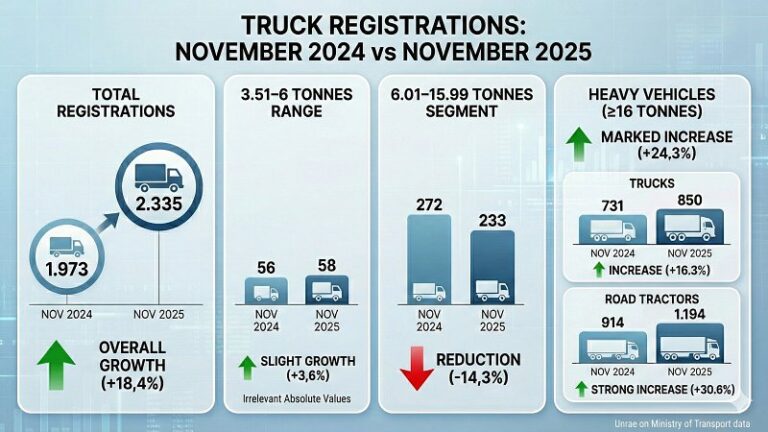

In November 2025 the market for industrial vehicles with a gross vehicle weight above 3.5 tonnes rose by 18.3%, according to the Centro Studi e Statistiche Unrae based on data from the Ministry of Transport. Registrations climbed from 1,973 in 2024 to 2,335 in 2025, the strongest result in recent months, although not enough to offset the losses accumulated earlier in the year. Between January and November 2025 total registrations reached 25.655 units, a decrease of 3.7% compared with 26,653 in 2024.

Segment performance remained uneven. Vehicles in the 3.51–6-tonne range increased slightly by 3.6%, although the absolute volumes were negligible, rising from 56 to 58 units. The intermediate 6.01–15.99-tonne band posted a 14.3% decline, falling from 272 to 233 units. Heavy vehicles with a mass of 16 tonnes or more recorded a strong rise of 24.3%, increasing from 1,645 to 2,044 registrations. Within this category both trucks, up 16.3% from 731 to 850 units, and tractor units, up 30.6% from 914 to 1,194 units, contributed to the growth.

The broader picture remains shaped by the slowdown in the first part of the year, which continues to weigh on the balance sheets of manufacturers and logistics operators. According to Giovanni Dattoli, president of the Industrial Vehicles Section of Unrae, the market is benefitting from a cyclical improvement but has not made up for the delays in fleet renewal. The sector faces challenges linked to the pace of technological transition and the pressing need to replace ageing vehicles, which are still widespread across the national fleet.

In this context, Dattoli stresses that even the imminent opening of applications for the new incentives on 17 December requires a reconsideration of how support is structured. The €9.2 million allocated to industrial vehicles for 2025 falls short of market needs and requires a more targeted distribution, while the use of the additional €6 million already earmarked for next year still has to be defined.

Dattoli also notes that purchase subsidies alone are no longer sufficient to steer demand towards lower-impact technologies. To reduce the total cost of ownership of more advanced vehicles, operational incentives are needed, such as motorway tolls differentiated by CO₂ emissions and exemptions for zero-emission vehicles, in line with the Eurovignette Directive.

The sector is also awaiting clarification on the extraordinary €590 million measure included in the ministry’s budget for 2027–2031, intended to support the scrappage of the most polluting vehicles. According to Unrae, these funds must be deployed within a strategy aligned with European targets and with manufacturers’ commitments, in order to provide stable support for the decarbonisation of road freight transport.