The first half of 2025 saw an improvement in Italy’s foreign trade performance. According to the 25th Fedespedi Economic Outlook, exports rose by 1.9% and imports by 3.9%, against a global GDP growth of 3% and an Italian GDP increase of 0.5%. Italy’s trade balance remained positive at €24 billion, in a context of price stabilisation and inflation below 2% since the end of 2024.

Fedespedi president Alessandro Pitto noted that the semester was marked by an “anticipation effect” linked to US tariffs, which pushed exports to North America up by 8.5%. However, geopolitical tensions and US protectionist policies continued to weigh on some industrial sectors, while the truce in the Middle East supported the reopening of the Suez route and the partial return of traffic through the Red Sea.

Globally, container traffic continued the growth trend started in 2024, with a 4.1% increase in the first quarter of 2025 compared with the same period of the previous year. In the first half of the year, global volume exceeded 95 million TEU, up 4.5%. The Far East remained the most dynamic export region (+8.2%), while Europe showed an 8.2% increase in import activity.

Non-Italian Mediterranean ports handled a total of 19.4 million TEU in the first six months of 2025, up 4.9% compared with 2024. Among Italian ports, Livorno and Gioia Tauro recorded growth of 11.8% and 10.5% respectively, while Genoa and Trieste saw declines of 1.3% and 1.7%, the latter affected by the end of the Maersk–MSC alliance. Service reliability improved, with 62% of vessels arriving on time by mid-2025 and the average delay reduced to 4.7 days from 5.3 in 2024.

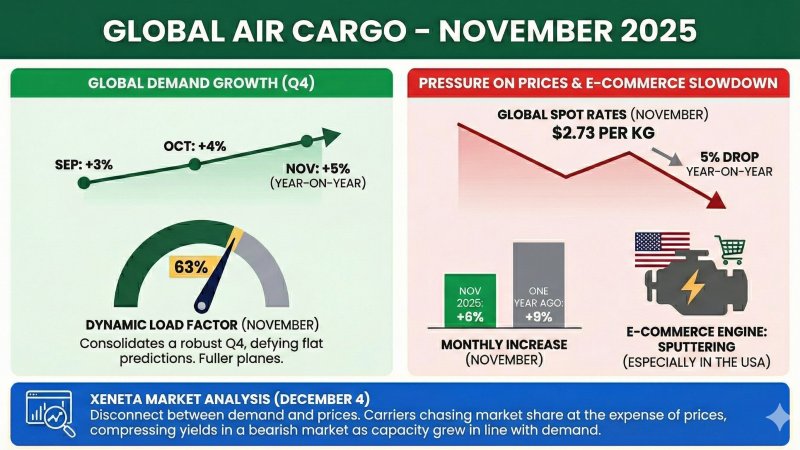

Air cargo showed signs of stability. In the first eight months of 2025, national freight traffic increased slightly by 0.3%. Milan Malpensa confirmed its leading role with 59.7% of national traffic and a 2.3% rise, followed by Venice (+1.4%) and Bergamo (+2.3%). At European level, Frankfurt retained its top position in the first quarter of 2025, while Malpensa ranked ninth and Rome Fiumicino fifteenth.

Italian exports to North America grew by 8.5%, raising the region’s share of total national exports to 12.3% compared with 10.9% in 2024. However, the new US tariff policy negatively affected several sectors: automotive (-24.4%), other manufacturing such as jewellery and musical instruments (-15.8%), and metallurgy (-11.1%). By contrast, exports of pharmaceuticals (+77.9%) and of maritime, aeronautical and rail transport equipment (+12.4%) expanded significantly.

According to Fedespedi, the return of stability in the Middle East and the gradual reopening of the Suez route could further support trade flows in the second half of the year, although the Cape of Good Hope route will continue to be used. Overall, the data confirm a recovering international logistics sector and a consolidating Italian foreign trade, despite a global environment still shaped by geopolitical and tariff-related uncertainties.