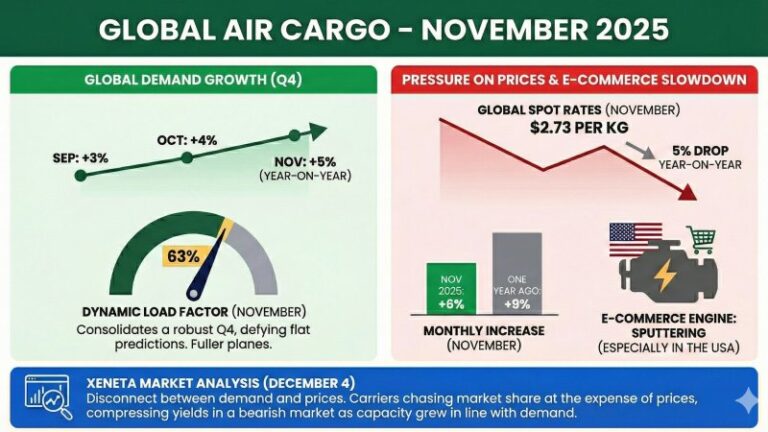

For the air cargo sector, Christmas 2025 seems to have arrived early, yet what carriers have found under the tree is a bittersweet gift: rising volumes but pressured yields, and a key growth engine – e-commerce – starting to lose momentum, particularly in the United States. According to Xeneta’s latest market analysis, published on 4 December, global air cargo demand in November increased by 5% year on year. This result strengthens an unexpectedly robust fourth quarter, marked by 3% growth in September and 4% in October, contradicting predictions of a flat peak season.

Despite fuller aircraft, with the Dynamic Load Factor reaching 63% in November, airlines are failing to convert this demand into annual price growth. Global spot rates fell by 5% compared with the same month last year, standing at 2.73 dollars per kg. Although there was a 6% month-on-month rise from October, the uptick was far more modest than the 9% surge recorded a year earlier. According to Niall van de Wouw, Chief Airfreight Officer at Xeneta, this disconnect suggests that carriers are chasing market share at the expense of pricing, squeezing yields in an already bearish market while capacity has grown in step with demand.

The most striking finding in the analysis concerns the impact of customs regulations on global flows, with e-commerce clearly slowing. The United States’ “de minimis” restrictions have had an immediate and dramatic effect, causing a 51% collapse in e-commerce volumes from China to the US in October. Europe, by contrast, has become the release valve for China’s export giants: e-commerce shipments from China to the continent have surged by 47%, supported by an agile shift of freighter capacity from the Transpacific to Asia–Europe routes. However, after 27 consecutive months of growth close to 40%, China’s total cross-border e-commerce sales were flat in October, marking a potential structural turning point ahead of reforms the EU will also introduce in 2026.

On the US tariff front, the analysis adds a note of realism: the effective tariff burden is settling between 10% and 12%, far from the 30–100% levels threatened in April. Although uncertainty remains high, this level is not yet dragging down consumer demand in a dramatic way. Xeneta cautions, however, that the real impact may hit in 2026 when, as inventories diminish, higher costs are passed on to end consumers just as US shopper confidence begins to weaken.

Looking ahead to the new year, the industry must brace for a difficult landing. Xeneta expects modest demand growth in 2026, stuck in the low single digits at around 2–3%. The structural challenge will be supply, which is set to grow faster than demand, keeping strong downward pressure on rates. In a stagnating market, the only way forward for forwarders will be to win volumes from competitors, pointing to a 2026 marked by fierce competition for market share to the clear advantage of shippers.

Antonio Illariuzzi